The Big Short (2015)

In the last article on Brooklyn (2015), I questioned the reasons why we gravitate toward the notions of the Promised Land and the Golden Age, and why the film, which is set in 1952, represents them as the American Dream with its youthful optimism in the year 2015. In this article, I am going to examine a highly acclaimed feature, The Big Short by Adam McKay (also released in 2015), which tells us what happened to the American Dream through four characters who were deeply involved with the financial crisis of 2007-08. It is a harrowing tale of greed, negligence, incompetence, and betrayal. Yet, the most sobering part of this exposé is: The failure of the system was not merely down to the individuals involved in the banking industry and/or the regulatory bodies; it is not even down to the system, which is rife with loopholes. Popular opinion is that it was the evil of the world of finance and the corruption of regulatory bodies which caused this particular crisis, and thus we need to hold those who are involved accountable, and clean up the system on which the world economy relies for its healthy function. Whilst McKay seems to be content to go along with this trend, if one follows the film closely, it becomes clear that there is a deeper and more fundamental problem. The systematic failure we love to discuss has its own cause. The most important problem is none other than the inherent nature of capitalism itself. And thus, we must realise that the American Dream, an optimistic manifestation of the ethos of Industrial Materialism, is flawed at its foundation. In short, it is a philosophical problem, not merely a political one.

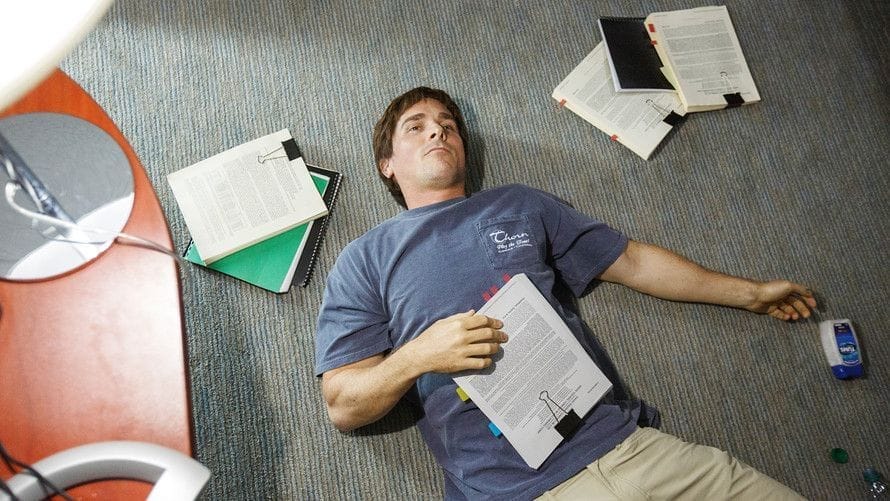

The Big Short is a film about the 2007 financial crisis, originating from the colossal corruption and oversight over the handling of subprime housing loans in the United States. It is based on the book, The Big Short: Inside the Doomsday Machine (2010) by the bestselling non-fiction author, Michael Lewis, who has been publishing insightful books based on his extensive knowledge and experience of the world of finance. The film gives us a unique view of the financial crisis of 2007 through the experience of four characters: Dr. Michael Burry (Christian Bale), an autistic neurologist turned hedge fund manager; Jared Vennett (Ryan Gosling), an ambitious bond salesman at Deutsche Bank; Mark Baum (Steve Carell), a hedge fund manager with an ambivalent attitude toward the industry to which he belongs; and Ben Rickert (Brad Pitt), a former banker who wishes to have nothing to do with the world of finance. It is clear from the artwork used for the promotional material that McKay chose a style popularised during the early 2000s; one story told through multiple points of view by assigning equal importance to many characters played by an ensemble cast. Interestingly, he chose to tell the story of this horrific degeneration in the format mostly used for romantic-comedies (Love Actually, directed by Richard Curtis and distributed in 2003, would be the most representative of this style), instead of focusing on one or two characters to intensify the dramatic effect. McKay assigns Vennett (Gosling) the role of ‘tour guide’ to the dark underbelly of the world of finance, assisted by the occasional elucidation of technical terms by Richard Thaler with Selena Gomez from the casino floor, Margott Robbie from the bathtub of her penthouse, and Anthony Bourdain from his kitchen. The result is a deceptively light-hearted tone which thinly veils the cynicism and despair. Naturally, the comic and irony expressed here are very dark, and Gosling’s Vennett embodies its spirit exemplarily. He is insufferable, unapologetically self-serving, and, above all, completely amoral. He is the face and the spirit of the hornet’s nest, and he makes a fool (or a hypocrite) of other players in the field, such as Baum (Carell), by enticing them into a devil’s pact which he carefully invents.

That being noted, it is important to recognise that Vennett’s attributes are shared by the entire financial sector and its regulatory bodies. Notwithstanding the frequent outburst of conscience, Baum accepts Vennett’s deal and pockets millions, and goes on to invest in one of the most precious ‘commodities’: water. Despite his retirement from the banking world and his deep wariness to it, Rickert shows that he still has what it takes in the world of finance. To be sure, he makes nothing from helping his ‘friends’. Yet, he gives us an impression that, at some level, Rickert is enjoying the fact that he is still very competent in what he is doing after many years of absence from the scene. Whilst I believe the sincerity of their frustration, anger, and despair over the way financial institutions operate, it cannot be denied that they achieve what they aimed for. The most interesting case in this story is that of Michael (Bale); due to his autism, despite being a prodigious hedge fund manager, he is very much an outsider; he is alienated from his colleagues, his employees, and his family. It is his exceptional acumen to ‘read numbers’ which sets the entire story in motion, firstly by betting on the collapse of the subprime housing loan and the world economy at large. Yet, he was ridiculed and treated like an idiot by the big banks who smirk and gladly take his money, believing that Michael is sure to lose the bet. Nobody takes him seriously until Jared Vennett overheard of one of his colleagues’ casual remarks on his ‘strange customer’ and the 'crazy' deal they made with this 'weirdo'. In the end, Michael is vindicated; just as he predicted, the world of finances collapse as the insidious scheme of subprime housing loans implodes. Whilst Michael correctly diagnoses the inevitability of a colossal economic crisis based on numbers alone, due to his autism, he cannot comprehend the seriousness of its implications in the same way Baum and Rickert do. Still, he recognises the toll his activity takes on him; he shuts down the hedge fund by stating how the business of money-making has deepened his alienation irreversibly. ‘No one’, he writes in his last e-mail to his investors, ‘speaks to me any more except through lawyers’. In the aftermath of the world-wide financial crisis, he wrote an op-ed for the New York Times and accuses the regulators' incompetence. This fact seems to indicate that he eventually recognised the questionable nature of his actions as a hedge fund manager.

To be sure, it is easy to dismiss the personal dilemmas, and even agonies, of these characters; after all is said and done, they reaped massive fortunes out of the disaster which turned countless people’s lives into dust worldwide. Whilst it is tempting to accuse those who are involved in the world of finance in any way, and it is true that they need to be held accountable for their actions and inactions, we should not lose sight of the deeper problem which caused this fiasco, namely, Industrial Materialism. I freely and openly admit that I have no expertise in economics, and thus am not qualified to discuss the merits and ills of capitalism as a system or to present an alternative to it. The point I wish to make here is solely focused on the ethos of capitalism. Capitalism is a product of philosophical dualism which understands the material world as a separate entity from our mind, or ‘soul’. Generally, this Cartesian dualism, broadly construed, implies that only humankind (except God) possesses the mental capacities, and thus it gives us permission to exploit non-human ‘objects’ as we see fit. It also transforms the way in which we regard the human body; the body itself is understood as a machine and should be treated as such. In short, bodies, human or non-human, can be now understood as commodities. This way of seeing the world has tremendous implications, and it transformed the way in which we see ourselves and the world wherein we inhabit. We now see ourselves as the master of the material world, which merely consists of raw materials for the production of goods. And the production enhanced by technological inventions means that we start over-producing goods. And this consistent over-production of goods necessitates the expansion of the market in order to keep the balance between supply and demand, which in turn ‘justifies’ the territorial expansion. In time, the limit to the imperial expansion (which ignited the paradigm shift from colonial imperialism to global free trade) coupled with the increasing production capacity necessitates industries to invent ‘needs’ and ‘wants’ to stay in the business, for business must perpetually increase the profit. And it is at this point in history that capitalism becomes ‘schizophrenic’ in a Deleuze-Guattarian sense; the so-called ‘reality’ in high-capitalist societies is nothing but the unregulated desires and fantasies spilling over to distort our world-view, and thus subjecting us to uncontrollable desires which we believe as our own. Whilst Cartesian dualism created the foundation of modernity, and thus helped us to promote the advancement of science, and the ‘liberation of men’ from older Form of Life bound with religious beliefs, the ‘liberated’ individuals could not find anything better than desiring. And the materialist world-view means that our desiring is the objectification of the world itself; even another human being in sight becomes a mere object of desire. We now live in the fantastical world in which each individual assumes that one’s freedom is absolute, limitless, and a birth-right, and thus one is going to do/have whatever one wants now. And, in the age of Industrial Materialism, the satisfaction must be sought in the possession of material wealth, and this goal must be achieved by technological means.

Armed with this absurd notion of ‘freedom’ and capitalism as the sacred ideology, the majority of Americans identify themselves with the ethos of capitalism, which demands the permanent and perpetual expansion of material wealth. This diagnosis is not limited to those who support so-called conservatism in the United States. As contradictory as it appears, this diagnosis also applies to the religious who are supposed to be the defenders of anti-materialist world-view. The political discontent and the narrative of dissent today is that the political and economic elite swindled and denied opportunities to the ordinary people, and they want to take back what they deserve from the hands of political and economic establishments. Notice that this narrative has not departed from the ethos of Industrial Materialism; whether one calls oneself a conservative or a liberal, or even a social democrat or a Marxist, in essence, they all want more of what they think they deserve. Nobody is asking oneself what it is that one wants and why. In the case of the housing loan crisis, before signing the dotted line, no one seemed to be asking oneself how one would be able to pay off the loans, or, more importantly, why one wants what one is about to buy in the first place. And before replying to these questions with a standard punch line (‘I do whatever I want! This is America, the land of the free!’), just pause and ask yourself what makes you think that you understand what it means to be ‘free’. Because if you cannot answer such an elementary question clearly, then you have no idea what you think you are talking about. And thus, the problem with our current society is ultimately a philosophical one; one should be asking oneself the most fundamental questions about one’s world-view, for mere political solutions would inevitably lead to another crisis dramatised in The Big Short. And from this particular standpoint of mine, it is clear that the so-called American Dream is fundamentally flawed. It is based on assumptions that state: 1) the accumulation of capital and the acquisition of goods are intrinsically good; and 2) there is nothing apart from communism to stop the perpetual economic growth. These are the assumptions which are held as orthodoxy without question in the United States and other capitalist societies. Whilst no one can provide a clear and consistent defence of the first notion, the second notion is already debunked by the environmental destructions we have created; the limit of our ecosystem on which all life depends is the blind spot for the likes of Adam Smith and Karl Marx, who represent the spirit of Industrial Materialism in their own unique ways. And thus, we can see the demise of the American Dream as our own struggle in the aftermath of a Cartesian revolution which bred the Industrial Materialism.

The Big Short is not a piece of great cinematic art, yet it is nonetheless an important film to be viewed at least once, for the hour is almost too late for us to pose the very question Michael asks at the end of his journey: What exactly is the point of making money? Whilst he won a bet handsomely, he is left with soul crushing hollowness. It is curious that this role was played by the actor who infamously embodied Patrick Bateman, the protagonist of the film, American Psycho (2000). Whilst the two characters are very different from one another, both represent the same diagnostic function for our Form of Life in which the dead souls, driven by insatiable and uncontrollable desires, material or sexual, know no satisfaction from their realisation. Whilst American Psycho remains an artificial demonisation of the privileged, The Big Short opens the door to the world of finance based on the experience of real characters. The only caveat is that this film represents only half the picture; whilst McKay tries to include the experience of the under-privileged, the scenes which include them appear as a mere afterthought. And thus, to have a better picture of the current state of the American Dream, I am going to look into Ryan Gosling’s directorial debut, Lost River, in the following review.

That being acknowledged, if one focuses on Michael’s story, this film opens us up to the question which must be asked by everyone: What is the point of all this striving for more? This is exactly the same question which Spinoza asked himself at the beginning of his philosophical journey as documented in his first title, The Treatise on the Emendation of the Intellect. In this first published work, the young philosopher examines the pros and cons of three most common objects of human desires, e.g., wealth, honour, and sensual pleasure, and reasons that none of them could bring us lasting happiness. Despite Spinoza’s warning, humankind chose not to bother with philosophical questions and proceeded with the newly acquired technological inventions to pursue the vices Spinoza rejected. Whilst McKay’s focus is a political aspect of the problem represented by this film, by following Michael’s story, this feature at least opens us to an old philosophical question which no one seems to bother asking.